In August 2010, PDVSA, Venezuela’s state oil company, published this annual report. On page 43 of the PDF, you can see the company’s investment plan. It was supposed to spend $58 billion on capital expenditures in 2013 in order to bring the Orinoco Belt into massive production.

It was one in a series of investment plans that made realistic projections for the year in process and absurd plans for massive spending two or three years out. According to the company’s annual reports, investment spending has gone up over the years. But it’s never accelerated as planned. Even the memory of the plans is now concealed: the report I have posted here is no longer linked up on the PDVSA website.

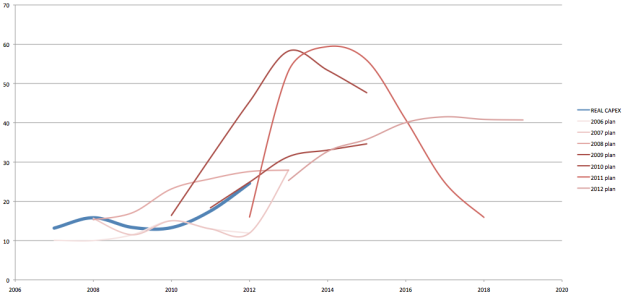

Yours for no extra charge, here’s a chart of the company’s investment plans over the years (in red tones) and real spending (the thick blue line). The left scale indicates billions of US dollars. The red lines show how much PDVSA planned to spend in each future year — back in 2006 and 2007, the idea was to creep along and magically get to 5.8 million barrels a day without much investment, then in 2008 projections rose to reflect rising oilfield service prices. In 2009, the plan suddenly recognized that the Orinoco Belt wasn’t going to develop itself, and would need tens of billions of dollars a year of investment. But 2010 came. Venezuela saw most international oil companies boycott the big Carabobo bid round in 2009, and both Statoil and Total declined to turn in proposals when they were invited to develop a new field. PDVSA’s cost of financing surged. Where would $50 billion a year come from? The latest plans show a bit more contact with reality, indicating a more or less gradual increase in investment until 2018.

The unfortunate part of this is that the peak spending year has been steadily pushed back in every plan. So Venezuela’s oil output keeps stagnating, and the country isn’t able to monetize its greatest natural patrimony. The good part of all of this is that every year Venezuela delays developing the Orinoco Belt, a lot of very dirty fuel remains in the ground. Long term, those of us who recognize climate change as important will be thankful for Bolivarian incompetence.

Sources: PDVSA Annual reports 2007-12

I suspect the increases in production go up in step with the increase in consumption of alcoholic beverages.

Hydrocarbon prices world wide are under pressure from the still ongoing horizontal drilling/fracking revolution. The US natural gas price collapse is just the first domino in that process.

We have not yet seen the industry capital deployment adjust to the change, but the PDVSA leadership must be very grateful they have not mortgaged the farm to develop the Orinoco Belt. They will instead muddle through until the new technology lifts the output.

The delay in developing the heavy oil deposits of the Orinoco region is becoming more and more structural in nature, as the political and financial environment in the country makes it impossible for any company to invest in this task. In parallel other energy sources are being developed elsewhere, which are becoming more and more competitive vs the Orinoco heavy oil. This is why I have been talking of a Florinda in the Winter syndrome, after the poem by Andres Eloy Blanco, dealing with a girl who had may suitors (Shell, Exxon, BP, TOTAL) but she rejected them because she was in her spring and her hands were full of flowers/suitors . Autumn came and she still had some pseudo suitors (China, Vietnam, Russia) and only one serious suitor (Chevron) but, again, she told him to wait. After she entered her winter there were no more suitors, because when love walks away in autumn it never comes back. The poem:

Al hombre mozo que te habló de amores

dijiste ayer, Florinda, que volviera,

porque en las manos te sobraban flores

para reírte de la Primavera.

Llegó el Otoño: cama y cobertores

te dio en su deshojar la enredadera

y vino el hombre que te habló de amores

y nuevamente le dijiste: -Espera.

Y ahora esperas tú, visión remota,

campiña gris, empalizada rota,

ya sin calor el póstumo retoño

que te dejó la enredadera trunca,

porque cuando el amor viene en Otoño,

si le dejamos ir no vuelve nunca.

Thank you, Gustavo. I think that sounds about right.

Leaving the oil in the ground has always been the right thing to do ecologically. Venezuela does have other resources that would be much less destructive to exploit, including water, tourism, hydropower, even gold.

Onward ho.